By Cate Bakos, Cate Bakos Property

Last week I was pondering the impact of the recent ANZ bank economist headline, suggesting that property prices are about to decline by 20%.

We’ve seen and heard these headlines through the cycles, and I cast my memory back to some of the fearful advice I received when I started out in property investing all those years ago.

My second property purchase was in 2000, and I recalled the comments that people in my circle of influence made.

Interest rates were climbing and for those who had experienced the challenges of the 1990’s when interest rates exceeded 17%, I must have seemed cavalier.

The purchase price and estimated returns were manageable though, and I shook off the white noise and ploughed ahead with the purchase. The house was particularly rugged, but the land was fabulous.

All of the reading I’d done had taught me that it is well-located land that appreciates.

One could argue that I timed it well. At the time I felt so clever turning such an amazing profit. We tidied the house up and lived in it as a principle place of residence. Just two years later, it was sold for close to double the purchase price.

In hindsight, that was one of my silliest rookie mistakes.

The property was a fantastic long-term keeper, yet I liquidated it. The land was redeveloped subsequent to the sale, but even taking into account the value of a basic home build, the gains would have been substantial.

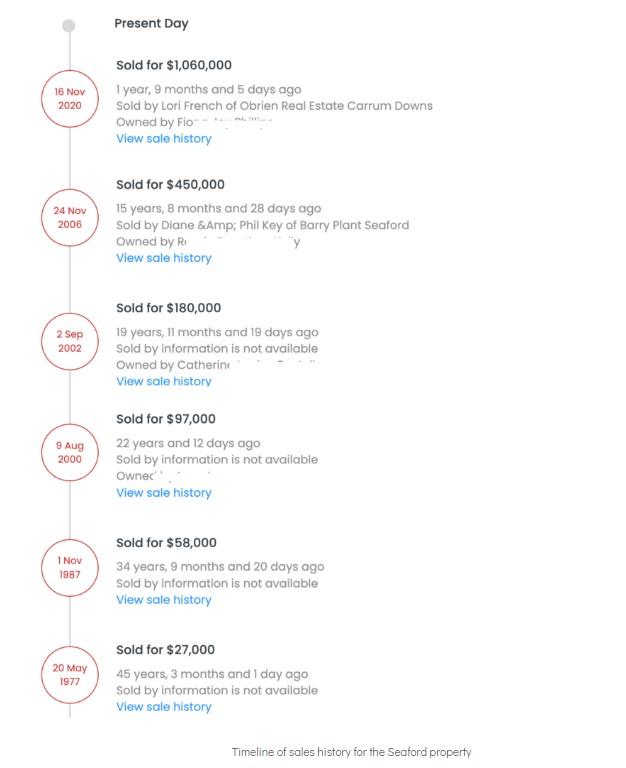

That particular acquisition and divestment got me thinking though, and I did learn from that mistaken sale. As I tracked the subsequent sales over the years for this pocket of Seaford, I realised that the real benefits come from time in the market. Had I held onto this asset (which had a debt of $20,000 on it by the time it was sold), it would have been worth more than one million dollars today.

But there were other learnings from this purchase too. Ignoring interest rate chatter and looking long-term, as opposed to trying to time cycles and interest rate movements did pay off.

I decided to take two more examples from my own investing experience and plot them on a cash-rate chart, and then to retrospectively look at their performance since their date of acquisition. This chart below shows the cash rate of the time. The green circle indicates the short period of ownership of the Seaford property mentioned above.

The yellow circle marks our first SMSF purchase, (shortly after legislation around instalment warrants changed, favouring leveraged property investment within a self-managed superfund). I was working in finance at the time and excitedly took advantage of the opportunity to borrow within the fund to purchase real property.

It should come as little surprise to hear that I was also warned against such an idea by others.

Welona was purchased in June 2008 for $560,000. This red brick, four bedroom beauty was the closest-to-a-capital-city-centre period house that I could identify at the time with the budget on hand. We chose Hobart as our city for this particular asset.

The proximity to the city centre has paid dividends for this investment, because this house has never had a single day of vacancy.

Current rental is $760pw, and the estimated annualised capital growth has been 6% pa.

Hobart has delivered exceptional capital growth of late, but it’s fair to say that we sat through a very static period for some years.

Interest rate cycles haven’t so much influenced the performance of this dwelling, but the point here is that the long term hold strategy has rewarded this investment decision that hinged on a combination of growth and yield.

Retiring the SMSF debt was our secondary intention for this asset.

The purple circle is indeed the interesting one.

This little Aspendale beachside cottage was purchased in December 2008 for $310,000, as GFC fears were rattling through our nation and when our RBA was bracing for an emergency interest rate cut.

I remember every outspoken piece of advice we were given about the impending market collapse, and in particular, our market timing being terrible for our little semi-detached beach house purchase.

Rates had been climbing and looking back, we bought this property at the highest peak of the current century.

This little property has delivered an annualised capital growth return of over 8%pa and was cashflow neutral within the first few years of ownership.

The impact of a long term hold strategy, regardless of media white noise, cannot be underestimated.

Ensuring affordability, cashflow and healthy buffers are in place is essential, but focusing on hype and headlines can steal time from investors who just want to start their investment journey.

Cate Bakos

Independent buyers advocate, qualified property investment advisor and experienced home finder, Melbourne

Main image: Freepik