By Kate Hill, Adviseable

If I’ve heard it once, I’ve heard it millions of times… “greedy” landlords driving up property prices and stuffing it up for everyone else.

Well, what a load of balderdash!

Of course, you’re probably thinking that I would say that given my clients are predominantly investors.

The truth of the matter is that savvy investors never drive-up property prices – rather it is those buyers who purchase with their hearts and not their heads that pay crazy prices for property.

Subdued investor activity

Here’s is some data to back up with I am saying…

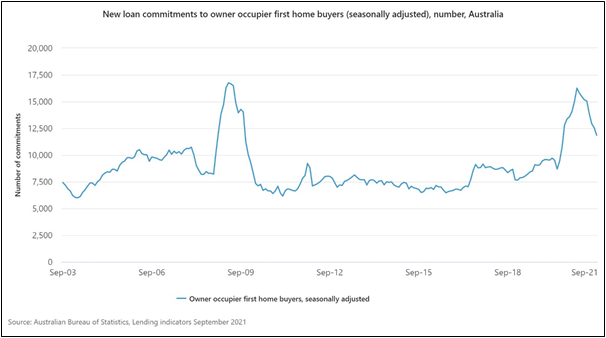

This graph from the Australian Bureau of Statistics Lending Indicators for September shows the volume of new loans taken out by home buyers (or owner occupiers) and investors over the past two decades.

You can clearly see that the number of homebuyers currently active in the market is far higher than investors – as is usually the case – but you can also see that the volume growth in homebuyer activity far exceeds the increase in investors activity over the past 18 months or so.

Indeed, property investor activity has been quite subdued for a few years, which means that its “growth” is also not what it seems.

Likewise, over the past year and a half, the numbers of first home buyers active in the market hit a decade high as many first-time buyers were motivated to purchase by various government handouts, such as the HomeBuilder scheme, as well as record low interest rates.

This last happened just after the GFC hit when, again, various stimulus measures were instigated, and interest rates were lowered, to protect our economy during times of financial turmoil.

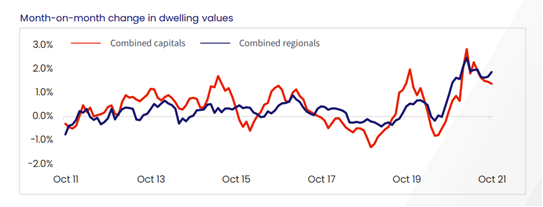

Now, here is one final graph that I was to share with you to support the thesis that it’s not investors that drive up property prices.

The latest CoreLogic Hedonic Home Value Index for November shows that dwelling values have risen by more than 20 per cent in most locations around the nation over the past year.

The thing is, investor activity remained at historical lows for about half of that time period, yet, owner occupiers and first-time buyers were purchasing property in record numbers.

How then is it that investors always get a bad rep for “driving up prices” and “forcing out first-time buyers?”

Indeed, over recent years, it has often been more difficult for investors to secure finance from lenders than the “average” lender, which is why so many have been absent from the market.

Likewise, the vast majority of investors have a set budget or price point in which they have to purchase to ensure that their investment makes financial sense to them, which prevents them from overpaying for a property.

Undersupply of rental properties

All the naysayers seem to have conveniently forgotten that investors also provide the vast majority of housing for renters in this county.

In fact, PIPA analysis of recent lending data found that from about 2007 to 2017, investors generally represented at least 35 per cent of the property market, however, for the past four years, their activity was constrained below this percentage due to the inequitable lending conditions at the time.

This has resulted in a significant rental property deficit in most parts of the country, which is causing rents to increase strongly and is creating financial and housing problems for many tenants.

According to SQM Research, the national vacancy rate’s most recent peak was in December 2016, when it hit 2.9 per cent – a percentage representative of a balanced market place.

However, since that time there had been fewer and fewer rental properties available for tenants in most parts of the country because of the subdued numbers of investors – which is not a situation that is likely to change anytime soon.