By Nicola McDougall, The Female Investor

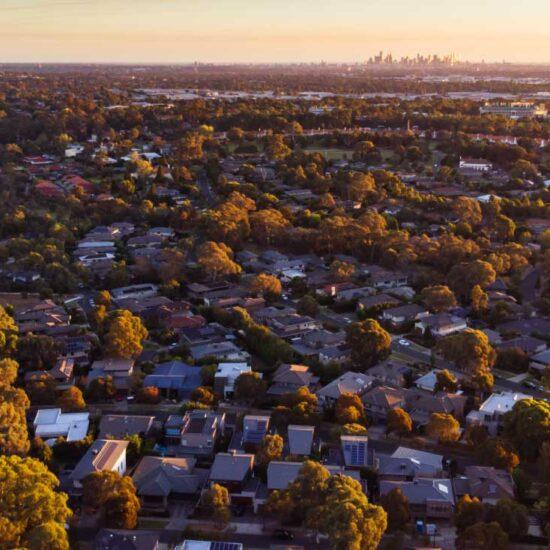

Over the past year, the national dwelling value has increased by the highest percentage for more than three decades, according to the annual Best of the Best Report from CoreLogic.

In reviewing the year that was, CoreLogic’s Head of Research Eliza Owen said the estimated value of Australia’s residential real estate had gone from $7.2 trillion at the end of November 2020, to reach a record high of $9.4 trillion in just 12 months.

In addition, sales volumes climbed to an estimated 614,635 in the past 12 months, the highest level in almost 18 years, as dwelling values nationally increased 22.2 per cent in the 12 months to November, the highest increase since 1989.

“Strong housing market performance over the year was driven by multiple factors, including low interest rates, fiscal and institutional support for households, high household savings and relatively low levels of advertised stock,” Ms Owen said.

“Rates of housing turnover had also been relatively low for some years before these factors boosted housing demand, which may also explain the elevated volume of sales in the past 12 months, which at November was 32.6 per cent above the decade annual average.”

Detached house values increased 24.6 per cent in the past year, outperforming the 14.2 per cent uplift in national unit values, according to the report.

Similarly, the 25.2 per cent increase in regional dwelling values surpassed the performance of the combined capital cities (21.3 per cent), which Ms Owen said was due to a variety of factors including extended lockdowns through 2021 and remote work trends.

“The popularity of regional Australia is reflected in many aspects of the Best of the Best report for 2021,” she said.

“The quiet coastal suburb of Yamba, in the Coffs Harbour-Grafton region of NSW, achieved the highest annual growth in units of suburbs across Australia, at 56.6 per cent.

“Regional suburbs were represented in many of the top value growth tables, including Ocean Grove units in Geelong (up 41.7 per cent in the year), Fraser Island units in Wide Bay (up 48.2 per cent), and Campbell Town houses in Tasmania (up 50.5 per cent).”

Higher-end lifestyle markets such as the Mornington Peninsula in Melbourne, the Northern Beaches in Sydney, and the Gold and Sunshine coasts in South East Queensland, were also among the year’s top performers, as internal movements from cities to regions increased.

“This may in part be attributable to how COVID-19 continued to shape demand trends, with coastal or leafy settings being more desirable as some workers were empowered to work remotely,” she said.

“However, this phenomenon may also just reflect market dynamics that have been observed in the housing market cycle over about a decade, where more expensive markets (particularly in Sydney and Melbourne) tend to show more volatility.

“This means during the upswing phase of the housing market cycle, expensive property markets in these cities will generally see higher growth rates.”

A surge in vendor activity resulted in a significant pick up in new listings, adding almost 51,000 new property listings in the four weeks to 5 December 2021. New listing figures for the same period in the previous five years averaged 41,800.

The number of auctions scheduled across the combined capital cities also reached a new high in the week ending 28 November (4,251) only to have the record broken again two weeks later when almost 5,000 properties went under the hammer.

It’s likely Australia’s property market has seen the peak of value increases as worsening affordability constraints, a surge in vendor activity and a recent tightening of housing finance conditions take effect.

While providing an outlook for the 2022 market, Ms Owen noted the likelihood that sales and listings activity had also likely peaked.

“The constraints of slightly tighter credit conditions, the erosion of housing affordability and a higher level of listings being added to the market are expected to see softer growth rates across property values in 2022,” she said.

“These forces are an accumulation of headwinds for property market performance. Softer growth rates are likely to coincide with fewer purchases, where sales and listings activity eventually move with momentum in price.”