By Vanessa Rader, Ray White Commercial

2021 has been a standout year for the commercial property market across the country; Bayside has been no exception with significant gains in sales turnover, capital value appreciation and yield compression.

The attractiveness of this location has fuelled new demand, boosted by an increase in local population from both within Queensland and the growing interstate migration, which increased and progressed the development pipeline notably for community assets such as childcare and medical facilities.

These sentiment shifts have also been felt in the rental market with new business starts improving occupancy levels and keeping rental levels stable across industrial and office.

However, food retailing and the pub market has been impacted by mandating of vaccinations, creating some uncertainties within this segment for staff, patrons and landlords.

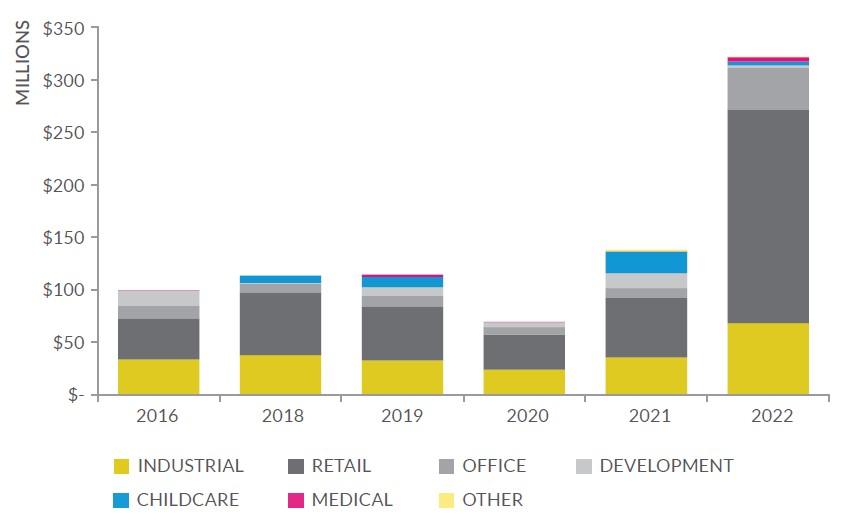

Bayside commercial sales turnover

2021 has been a landmark year for commercial sales across the Bayside region, exceeding results from prior years in terms of volume and number of transactions.

Sales grew to $321.89 million which represents an 132.98% increase on 2020 results.

While this high level of sales has been propped up by the Victoria Point Town Centre sale at $160 million, when excluding this sale, volumes still exceeded 2020 results by 17.17%.

The strong appetite for investment has centred around traditional commercial asset classes this year, with limited childcare and medical sales.

While these emerging assets have been showing robust results around the country, limited available assets on the market has seen this segment decrease this year.

Industrial has grown to represent its largest volume of sales on record in 2021 at $68.36 million represented by 75 transactions. The affordable price point proved attractive to owner-occupiers as well as the investor market.

Despite uncertainty in the community borne from COVID-19, both retail and office assets have not witnessed any dampening in demand, with enquiry and transactions up notably in the second half of 2021.

Bayside commercial sales turnover by asset class

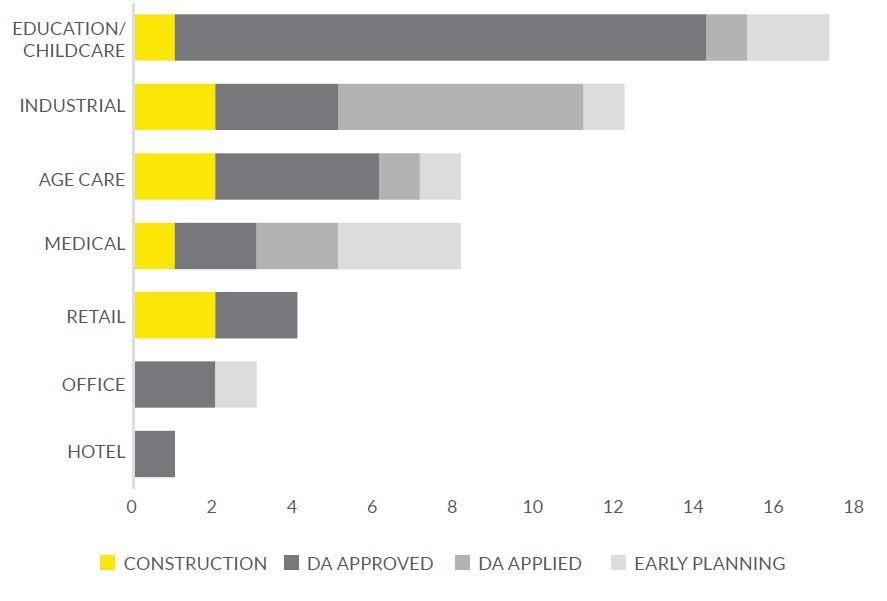

Non-residential development pipeline

With occupancy levels showing some improvements and the lull we have seen in construction over the past two years, we expect to see some rebound in development activity in 2022.

Population movements to Queensland has benefitted the Redland Shire and as such we have seen a rapid increase in both apartment development and residential subdivision sales.

This growth in the residential sector has impacted commercial markets, in particular community type assets with 18 new education/childcare developments currently in the pipeline, while aged care and medical developments are quickly advancing with nine projects currently under construction or DA approved for completion over the next two years.

There are 12 industrial supply projects earmarked for development, with the two currently under construction adding 11,120sqm of stock to the region.

While more than half of this stock is committed, given the huge increases in construction costs we are unlikely to see much speculative development being undertaken.

There is a further 50,000sqm of industrial stock with DA approval and over 25,000sqm in DA applied or early planning phases which is likely to come online as demand grows.

Non-residential development pipeline – no. projects, Redland Shire LGA

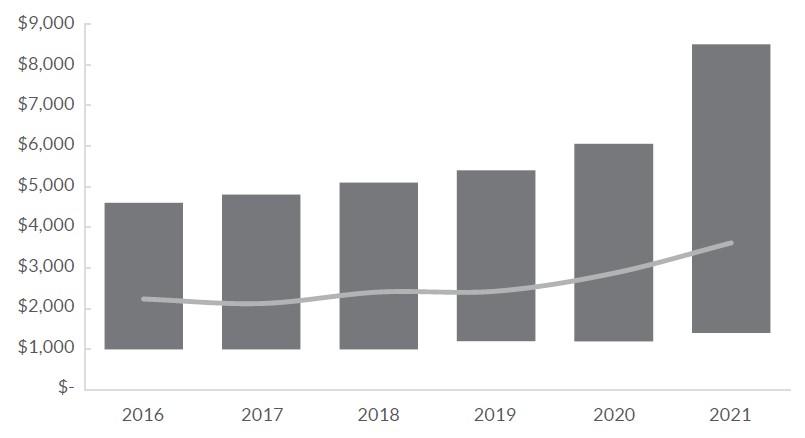

Small commercial asset capital values

Turnover levels have shown outstanding results in 2021 and with high demand growing these sales, competition among owner-occupiers and investors has seen values show some uplift.

Low interest rates and the weight of funds available have made investing in commercial more accessible than ever before, resulting in an uptick in first time buyers.

As a result, we have seen average capital values improve and investment yields reach new lows across all asset classes. Despite these overarching results, we have still seen these value ranges vary considerably based on size, location and income.

This year, the range in values has increased to $1,400/sqm to $8,500/sqm with a total average for the area to $3,614/sqm; a 25.97% increase on the 2020 result of $2,869/sqm.

Attractive to a range of local and interstate buyers, industrial has had the greatest number of transactions this year, recording 75 with an average sale price of $911,430 and capital values of between $1,400/sqm and $3,000/sqm or an average of $2,332/sqm.

Office and retail assets continued to have strong increases with averages of $4,358/sqm and $5,154/sqm respectively.

Small commercial asset capital values – range and average $/sqm

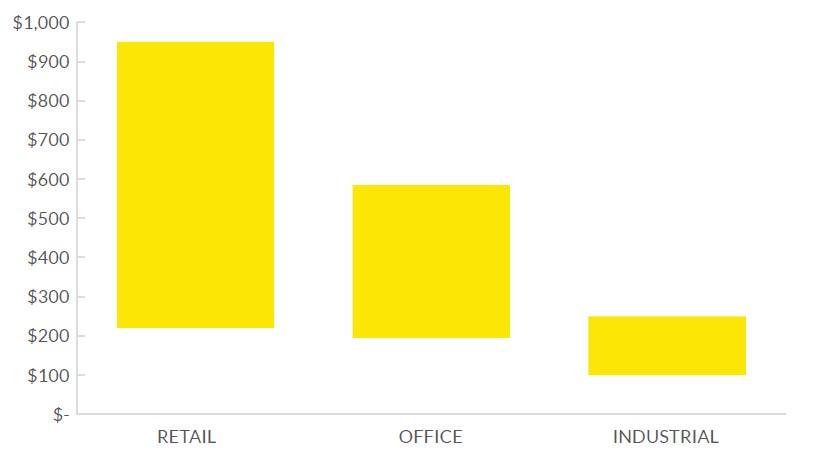

Bayside gross face rents 4Q 2021

2021 saw much improvement in sentiment around workplaces, which had positive impacts on rents. However, changing regulations surrounding vaccination mandates, notably in food retail settings, put some uncertainties back into the market in late 2021.

Overall, we continue to see rents remain broad driven by various levels of quality, particularly for retail which can vary substantially depending on location, access, parking, quality and size, with ranges from $250/sqm to $1,000/sqm gross.

For retail, we’ve seen a preference for strip shops with their minimal internal malls/enclosed spaces and open air parking seen as a more hygienic option, which is likely to continue into 2022 given the rapidly escalating Omicron variant.

Office space continues to trend within the $150/sqm to $550/sqm gross range as some businesses and their staff seek satellite locations.

Smaller stock take-up remains high as tenants look for alternatives to working from home.

Industrial continues to show the greatest levels of activity, again in smaller unit spaces of sub-500sqm.

These assets can broadly range from $100/sqm to $260/sqm gross.

Bayside gross face rents 4Q 2021 – range and average $/sqm

2021 has been an encouraging year.

Despite the roadblocks caused by COVID-19 we have seen the local economy rebound with improving occupancy and vibrancy returning to our local employment zones.

With commercial markets performing well across most of the country and a slowdown in new development widespread, investors continue to look further afield for quality commercial investments, resulting in strong turnover and values for Bayside.

Looking ahead, the opening of borders and the return to normal has had some disruption due to the Omicron variant and vaccination mandates for some of the community, which will impact some asset classes and the broader economy.

This, however, is unlikely to stifle the appetite of buyers looking to secure a foothold in a growing Queensland commercial market, with transactions expected to continue at a strong pace, setting new benchmarks in value for some assets.

Industrial is expected to remain in favour for many buyers, while alternatives such as medical and childcare facilities will also see increased demand.

Main image: DepositPhotos