By Nicola McDougall, Editor, The Female Investor

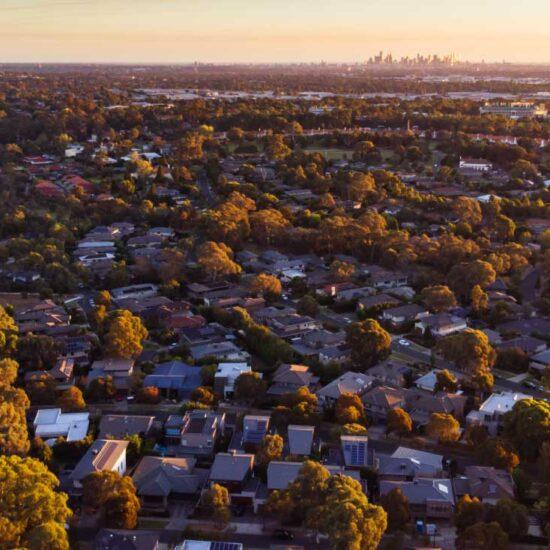

Red hot Regional Australia property markets are showing signs of slowing, despite outpacing capital cities due to chronically low listings and sustained buyer demand. CoreLogic’s latest Regional Market Update shows the growth rate across Australia’s 25 largest non-capital city regions has slowed from a peak of 6.6% in April 2021 to 4.7% in the three months to April 2022.

Red hot Regional Australia property markets are showing signs of slowing, despite outpacing capital cities due to chronically low listings and sustained buyer demand.

CoreLogic’s quarterly Regional Market Update, released today, shows the growth rate across Australia’s 25 largest non-capital city regions has slowed from a peak of 6.6% in April last year to 4.7% in the three months to April 2022.

Dwelling values across the combined regions jumped 23.9% in the year to April 2022, outpacing the combined capital city dwelling growth rate of 14.6% for the same period.

CoreLogic’s Research Director Tim Lawless says there are many reasons why the rapid rate of growth for regional areas has continued as conditions in capital city markets, particularly Sydney and Melbourne, have softened in recent months.

“Although demographic data is significantly lagged, anecdotally we are still seeing strong demand for regional housing supported by high internal migration rates,” Mr Lawless says.

“The high level of demand is supported by estimates of home sales, which were tracking 20.1% above the previous five-year average over the three months ending April 2022.

“It seems many employers across the relevant industries have implemented permanent hybrid working arrangements for staff which is likely to be supporting the stronger demand trend across regional Australia.”

Generally regional housing prices remains more affordable than their capital city counterparts and while the comparison doesn’t always hold true for the most popular regional locations, Mr Lawless highlights examples such as the Newcastle and Lake Macquarie region where median dwelling values remain $250,000 lower relative to Greater Sydney.

Similarly the Illawarra region’s median dwelling value is $143,000 lower relative to Sydney’s, Geelong dwelling values are $5,350 cheaper relative to Melbourne and Ballarat housing values are $203,000 lower relative to Melbourne’s median.

The quarterly Regional Update shows Hunter Valley, excluding Newcastle, was the best performing non-capital house market, with an annual growth rate of 34.3%, leapfrogging Southern Highlands and Shoalhaven (33.3%).

Mr Lawless says the figure was more about a slowing rate of growth in the Southern Highlands and Shoalhaven region rather than an acceleration in the growth rate across the Hunter Valley.

“We are likely seeing worsening affordability pressures limiting the rate of growth across the Southern Highlands and Shoalhaven, where the quarterly rate of growth has reduced from 9.7% late last year to 5.6% over the most recent three month period,” he says.

“Across the Hunter Valley region the median value of a house is still well below $1 million implying less dampening pressures from worsening affordability.”

The largest change in sales volumes was recorded in Central Queensland (Qld) and New England and North West (NSW), which both recorded a 42.9% increase in house sales over the year to February 2022, followed by Queensland’s Townsville (41.2%), Mackay – Isaac – Whitsunday (40.8%), Wide Bay (36.1%) and Cairns (35.6%) regions. At the other end of the scale, Victoria’s Latrobe – Gippsland region recorded the lowest change in house sales over the year to February 2022 (2.4%).

Houses in Toowoomba (Qld) sold fastest in the 12 months to April 2022, where the median time on market was 13 days, followed by Queensland’s Sunshine Coast and Gold Coast, where both regions recorded a median time on market of 16 days.

The slowest selling region for houses is the New England and North West region in New South Wales, where the median time on market was recorded at 46 days over the same period.

The Hunter Valley exc Newcastle in New South Wales is offering the lowest discount to secure a sale (with a median discount rate of -1.8%), while the highest discounts are being offered across the Mackay – Isaac – Whitsunday region in Queensland, with vendors offering a median discount rate of -4.2% in order to secure a sale.

Across Australia’s regional unit market, the Launceston and North East region in Tasmania saw a 30.9% increase in values over the 12 months to April 2022, making it the best performing unit market. This was followed closely by Queensland’s Sunshine Coast (29.3%) and Gold Coast (28.4%) regions. At the other end of the scale, Queensland’s Mackay – Isaac – Whitsunday (0.9%) and Townsville (2.2%) regions saw minimal growth over the same period.

Although the median days on market and vendor discounting figures remain low, both metrics have softened in recent months. However, Mr Lawless says the number of homes available for sale across Regional Australia is more than 40% below the five-year average and 20.5% lower than a year ago.

At the same time, sales activity was tracking about 20% above the five-year average across Regional Australia.

“Clearly we are still seeing a disconnect between available supply and demonstrated demand,” he says.

“These conditions favour vendors over buyers. Buyers in tightly supplied housing markets are probably feeling a bit rushed in their decision making process and will generally have little opportunity to negotiate on the advertised price.”

As interest rates move higher and affordability pressure mount, Mr Lawless says the outlook for non-capital regional markets is for a softening in growth rates to more sustainable levels.

“Arguably some regional markets will be somewhat insulated from a material downturn in housing values due to an ongoing imbalance between supply and demand,” he says.

“We are continuing to see advertised stock levels remain extraordinarily low across regional Australia and settled sales activity looks to be holding firmer relative to the capitals. A lot will depend on regional migration patterns and we expect the demographic trends to continue favouring regional housing markets, especially those regions with some lifestyle appeal within a few hours’ drive of the major capitals.”

Download your copy of the Regional Market Update here.