By Kate Hill, Adviseable

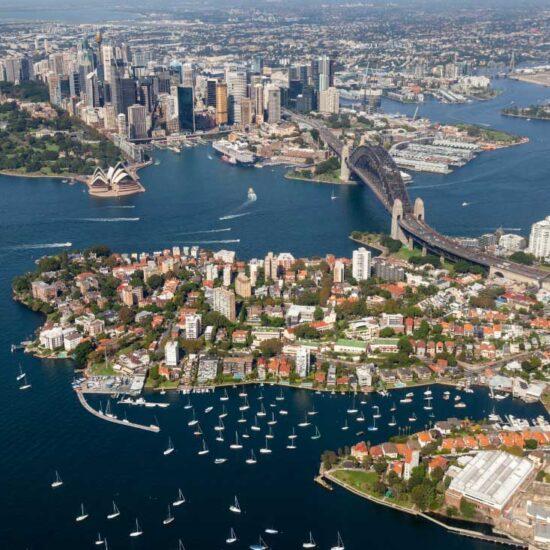

As regular as clockwork, recent media stories have been highlighting how seemingly ridiculous property prices have become – especially in Sydney.

A case in point is a recent story using a multimillion-dollar house sale in Campbelltown as an example of why it is “impossible” for first timers to buy any real estate of any type in the Harbour City.

To add to the supposed “evidence” was a helpful interview with an 18-year-old who was outraged that she was forever locked out of the Sydney market.

Well, what a load of balderdash!

One of the factors that differentiates homeowners and property investors from people stuck on the sidelines waiting for the inevitable “crash” is the ability to look past these types of alarmist stories.

Consistent and sustainable growth

The trajectory of property prices in Australia over the long-term, by which I mean decades, shows how they increase consistently over time.

There are myriad reasons for this but one of the main one is supply and demand, which is the basis of standard economic theory after all.

Over those many years, sure, there were periods where prices rose more quickly, other times when they flat-lined, and sometimes when they might even have softened somewhat.

But what is vital to understand is what happens to property prices when all these market cycles are evened out – which is a steady and sustainable increase in the value of real estate assets.

There is nothing in the long history of property investment as a wealth creation vehicle that suggests this will change in our lifetimes.

However, to create wealth via real estate you must buy something at some stage.

Rather than complaining that your first property might not be the castle that you had envisioned growing up, most of us had to start with a dwelling that was quite modest and then upgrade as time went on or use the equity to create a portfolio.

New research out of CoreLogic has found that first-time buyers who are middle income earners in Sydney have the purchasing capacity to afford about 24.5 per cent of houses and nearly 60 per cent of units in the Greater Sydney region.

Indeed, the borrowing capacity study found that the purchase price for middle income earners is around $685,723 around the nation.

In Sydney, that purchase price does not go as far as in other locations admittedly, but it also provides plenty of opportunities for first-time buyers.

Affordable options available

For around that figure, would-be property owners can still buy an established house in western Sydney, which might need a bit of love, but would make an ideal first rung on the property ladder for most people.

The unit market in Sydney is starting to strengthen but is lagging behind the price growth of the house market.

This means that there remains plenty of opportunities to purchase established units, often in superior locations, for an affordable price.

For example, the median unit value in Sydney is currently $771,000 but the median house value is $1.147 million, according to CoreLogic.

Prospective property owners still have the ability to buy into some desirable locations by purchasing an established unit that ticks all the investment fundamentals as well.

At the end of the day, what I am trying to say is we live in Australia, the best place in the world!

So, wherever you are going to buy, the sky is still going to be blue, and you are still going to be surrounded by ocean, plenty of fabulous things, and lots of nice people.

If you must start small or buy further afield for a few years, then that is what you must do, which doesn’t seem so bad at all does it?