By Kate Hill, Adviseable

New research by the Workplace Gender Equality Agency (WGEA) has proved this inconvenient fact with women in the prime of their careers as CEOs or directors earning nearly $100,000 per year less than males.

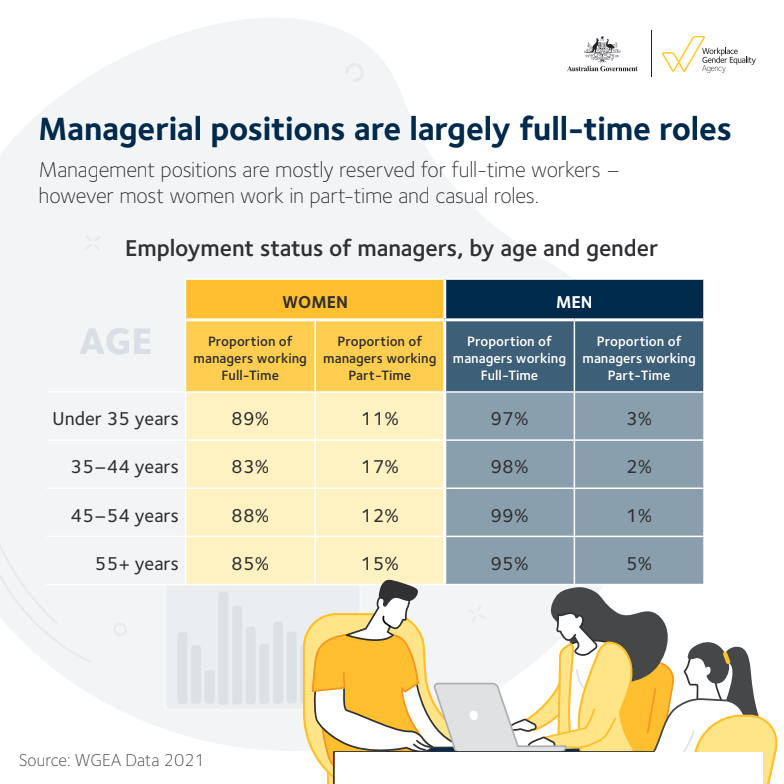

It is hard to fathom how this disparity can still be occurring in the 21st Century, but it’s partly due to the fact that people- or company-leading roles generally have to be full-time and women often can’t make that commitment because of their responsibilities at home.

The study also found that at every age and stage of their working lives, many women are not working full-time, which of course negatively impacts their earnings as well as their opportunities for promotion to managerial roles.

A new study, the Wages and Ages: Mapping the Gender Pay Gap by Age data series, was the first time WGEA data has been broken down by age.

Alas, the research showed that there is never a time when more than 50 per cent of women are working full-time, but more than 90 per cent of managers are full-time roles.

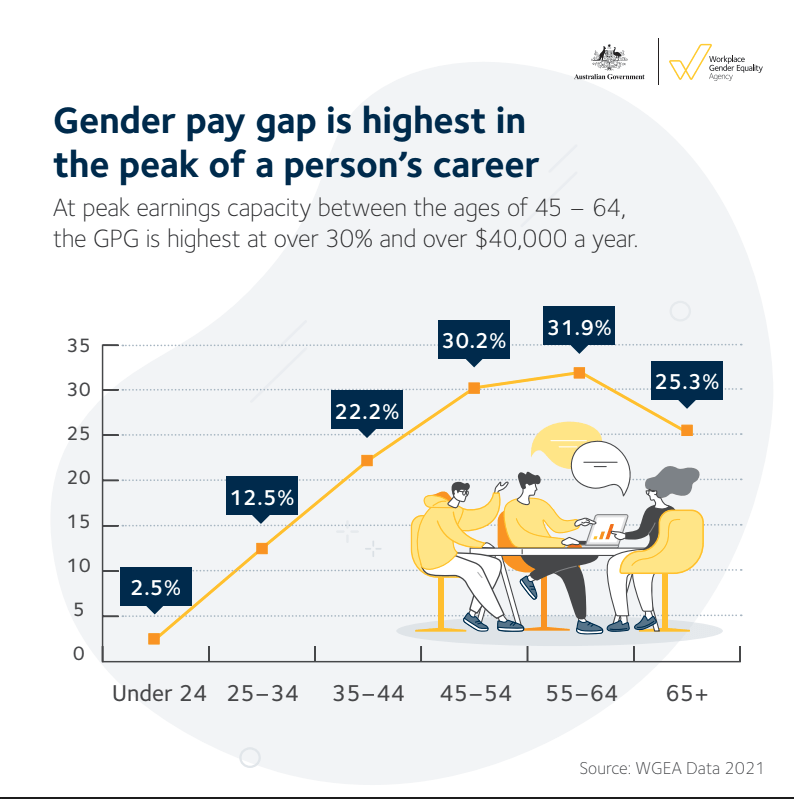

As we pointed out in our book, The Female Investor – Creating Wealth, Security, & Freedom Through Property, the divergence in financial outcomes between genders starts early in your career with women’s superannuation balances falling behind from their late 20s.

The WGEA study also found that a divergence in working patterns starts to occur from the age of 35 onwards, when men are predominantly working full time and women are predominantly working part time or casually. Other findings included:

- Men over the age of 55 are twice as likely to be in management than women.

- For the women who have made it to managerial ranks at the same age, two-thirds are in lower tiered management ranks.

- The data also shows that men out earn women across every generation. This peaks at ages 55 – 64, where men out earn women by 31.9 per cent, or more than $40,000 on average per year.

- Even women who have reached senior executive and CEO roles at age 55 and over still face a large earnings gap, taking home about $93,000 per year less on average than their male senior executive and CEO counterparts.

I find these kinds of statistics appalling in today’s society and you should, too.

If we combine lower lifetime earnings and lower superannuation balances, with the fact that relationship breakdown forces many women into a poverty trap and potential homelessness, it is vital that every woman does what they can to secure their own financial future.

Women will no doubt continue to be the predominant caregivers of their children for some time to come, so, hopefully businesses become more conscious of this fact and introduce policies that welcome womens’ skills and normalise time out of the workforce. Plus women can take charge themselves as well.

Women can improve their financial futures

One simple way of doing this is to purchase an investment property that you retain ownership of independently throughout your life. In fact, I know of women who have been able to purchase more than one by ensuring they strategically selected the first property to maximise its future capital growth potential.

There are also many instances of women who have improved their financial futures post relationship breakdown or the death of a partner by using property investment as a wealth creation vehicle.

While we wait for policymakers to address the gender pay gap, it is equally as important for women to prioritise their own financial hopes and dreams – with property investment being one of the most low-risk ways to do so.