New exclusive industry research has found that rents have grown at only half the rate of inflation for more than a decade – even after allowing for the past year’s rent increases and the current inflation spikes. Ongoing anti-investor sentiment is set to deepen the rental crisis, too, according to industry experts.

The Property Investment Professionals of Australia (PIPA) and the Property Investors Council of Australia (PICA) have joined forces to highlight the financial reality for millions of property investors in the face of sharply rising ownership costs.

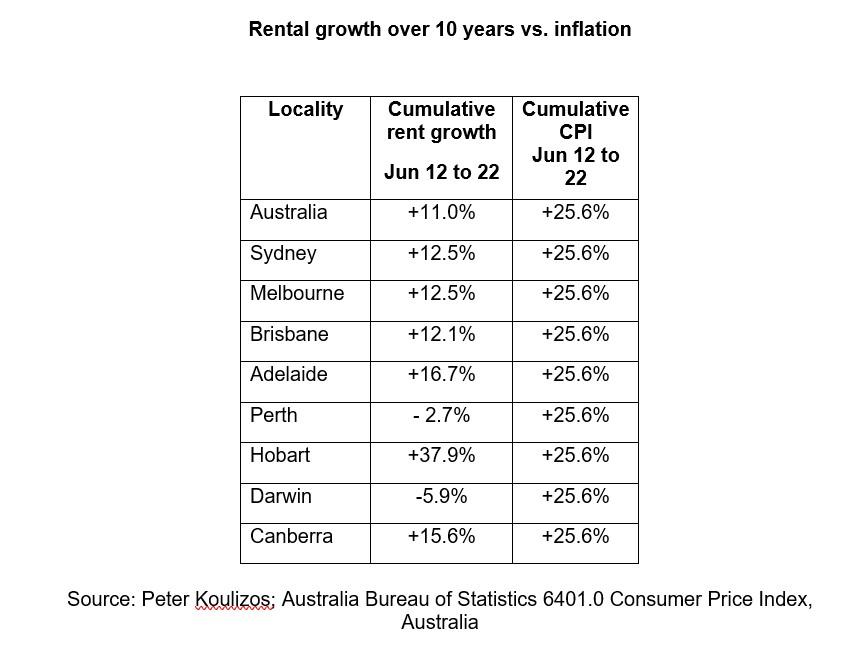

The research – using the Australian Bureau of Statistics Consumer Price Index from June 2012 to June 2022 – by renowned property academic, Peter Koulizos, found that rents increased by just 11 per cent nationally over the decade, but inflation rose by 25.6 per cent over the same period – a shortfall of nearly 15 per cent.

On an annual basis, rents increased by about one per cent per year, versus average inflation increasing at more than two per cent each year over the decade.

Mr Koulizos also analysed results at a capital city level, which found that rents didn’t keep up with inflation in every capital city apart from Hobart over the period.

“These results clearly show that rental growth has been below inflation for more than a decade, even with the recent spurt of rental price pressure,” Mr Koulizos said.

“As well as their cash flow taking a hit because of this income versus inflation imbalance, investors have also had to finance a huge variety of additional costs levied by all levels of government over the past decade.

“Governments deserted the supply of affordable rental properties years ago, expecting private investors to simply take over this responsibility, however more and more investors are deciding that it’s just not worth it.”

The analysis also found that the rents in Sydney are at the same level as 2016, with Melbourne posting rent at the same level as 2018.

PIPA Chair Nicola McDougall said the volume of investors in the market was below historical averages for half of the research period as well, predominantly due to lending restrictions and yet rents remained well below inflation.

“The lending restrictions in 2017 unfairly targeted investors, with many unable to transact for a number of years,” Ms McDougall said.

“From that period of on, the supply of rental properties started to dwindle because investors simply couldn’t qualify for finance – but this research shows that rents have not kept up with inflation.

“Since the start of the pandemic, investors were initially asked to ‘take one for the team’ and supply free or low-cost housing to their tenants; are continually expected to pay higher costs for everything property-related – from council rates to stamp duty; and will soon be ‘double-taxed’ by the Queensland Government.

“It’s little wonder that we have heard of investors selling their properties in droves over the past two years because many have simply had enough.

“And let’s not forget that 71 per cent of investors own one property and 90 per cent own just two – this has always been the case – contrary to popular opinion about a plethora of mega-rich people who seemingly own dozens of properties.”

PICA Chair Ben Kingsley said that private owners of rental properties had shouldered the bulk of rental supply heavy lifting over the past two decades, while governments axed billions of dollars from public housing funding.

“These rental providers have also been pressured to carry the full financial burden of rising interest rates, new tenancy reforms, eviction moratoriums, land tax reforms, huge and costly delays in tribunal dispute hearings, and yet over the past 10 years, outside of Hobart, rents haven’t been keeping pace with inflation,” Mr Kingsley said.

“The current rental crisis is the result of government inaction and market interventions. There is no question that governments, at all levels, have played the biggest role in the rental supply mess – but, year after year, they expect private rental providers to simply pay more and more.

“Well, I’ve got news for you, more and more investors are saying ‘enough is enough’ and are selling up with many, many more expected to follow. The severity of the current rental crisis will look like a walk in the park compared to what will happen next, mark my words.

“Our industry has been warning State Governments for years that every time they change legislation in their markets, they upset the market balance and there are unintended consequences – we are seeing that play out now and there appears to be more silly legislation to come.

“We just pray they wake up to themselves and start valuing the vital role that ‘mum and dad investors’ play in the provision of housing in this country – or step up to the plate and come up with a viable and achievable plan to greatly increase the supply of rental properties in this country.”