By Kate Hill, Adviseable

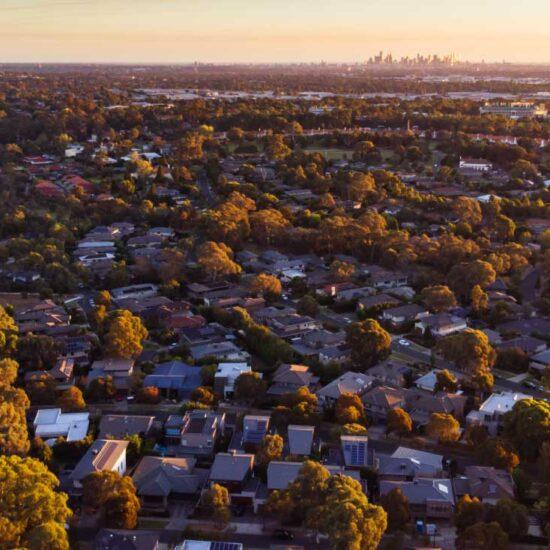

Before the pandemic darkened our doors a year ago, a number of property markets around the nation were already experiencing rising market conditions.

In fact, after a softer marketplace for nearly two years following the peak of the boom, even Sydney property prices had been strengthening in a consistent way.

Of course, COVID19 made all of us consider what was ahead of us, with property prices being only one part of the equation.

However, as the year progressed and our nation handled the crisis admirably, the combination of record low interest rates, construction stimulus measures, and more money generally in all of our pockets property prices started to reignite.

In fact, according to CoreLogic, dwelling values are rising at the fastest rate for some 17 years with more price growth forecast for the next year or two in many locations.

Demand outweighing supply

The sharply rising market conditions are also due to the significant uptick in buyer demand at the same time as property listings being unusually low.

This means that we’re regularly contacted by potential clients who have missed out on buying a number of properties over recent months.

Sometimes, they simply haven’t been prepared to offer market price for a property, which is vital in a rising market.

However, other times, it’s because the criteria for their new home is just too narrow, which drastically reduces their potential options.

Many homeowners have their suburb of choice to live in, of course, but when there is far more demand than supply, and prices are surging in a sellers’ market like now, then being flexible on location might be needed.

Sure, in an ideal world, everyone would be able to buy where and what they want.

But such “market nirvana” rarely exists and certainly doesn’t when hordes of buyers are competing for the limited number of properties on the market in highly desirable locations across the nation.

Many neighbouring suburbs in myriad cities generally offer similar attributes but can have different price points depending on their perceived prestige amongst buyers.

Indeed, buying into a more affordable suburb that is next door to a more exclusive one can make sound property investment sense more generally with the potential for excellent capital growth.

Flexible thinking

Likewise, the same mindset should be adopted when it comes to property types, land sizes or dwelling configurations.

Some potential purchasers stick rigidly to buying a lifestyle property but forever miss out because they aren’t prepared to pay what is needed to secure this type of in-demand property.

The same can be said for dwelling types, with some people stubbornly insistent on buying a house in a particular location when they can’t actually afford to do so.

However, they do have the funds to buy a premium unit with scarcity factor in the same location but would rather miss out entirely than rain on their house ownership dreams it seems.

Another element that buyers should have flexibility on is when it comes to the number of bedrooms or bathrooms a potential home should have.

While I would never suggest purchasing a property that fundamentally won’t suit your needs, there are ways to change the internal features of a property as long as it has the structural specifications to do so at some point in the future.

Even two-bedroom apartments can potentially be turned into three-bedroom ones with an ensuite to boot sometime down the road.

I guess what I’m trying to say is that with property prices rising so quickly, buyers who are not flexible enough may wind up missing out on this market cycle altogether.