By Nicola McDougall, Editor, The Female Investor

Addressing the critical undersupply of rental properties must be a key policy of whoever wins the upcoming Federal Election.

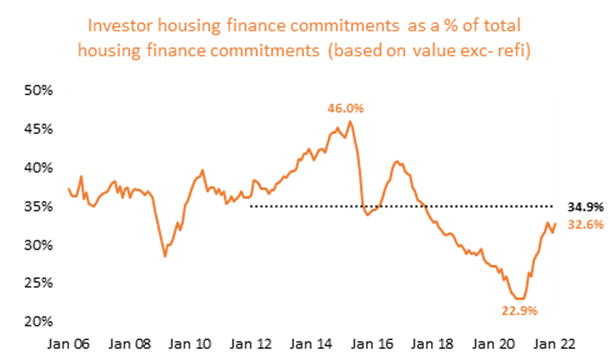

Residential rental vacancy rates have hit 16-year record lows due to investor activity being well below average over the past five years in particular, according to new research.

While investors made a return to the market last year, they had been mostly absent from the market for a number of years beforehand, which significantly reduced the supply of rental properties available for tenants.

According to CoreLogic analysis, investors comprised 32.6 per cent of mortgage demand by value in January 2022, up from a recent record low of 22.9 per cent, but below the decade average of 34.9 per cent.

The main reason why many investors did not purchase properties from 2017 is that nationwide lending restrictions prevented them from doing so.

At the time, the restrictions were mainly because of the strong property price growth in Sydney during the mid-2010s, however, the instigation of fewer interest-only loans as well as higher interest rates on investment loans impacted investors around the nation.

At the same time, asking rents were mainly benign, so the combination of higher mortgage costs together with flat-lining rents were also an impediment to the investor market.

According to SQM Research, the national residential property rental vacancy rate fell to 1.2 per cent in February 2022 – a fresh 16-year low. Available rental properties plunged in the Melbourne and Sydney CBDs, while capital city asking rents have soared 9.4 per cent over the year to March.

SQM Research data also shows:

- In Brisbane, the vacancy rate has fallen from 3.5 per cent in March 2017 to 0.9 per cent in February 2022. The asking rent for houses has increased 19.5 per cent over the year to March.

- In Adelaide, the vacancy rate has fallen from 1.7 per cent in March 2017 to 0.4 per cent in February 2022. The asking rent for houses has increased 15.6 per cent over the past year.

- In Perth, the vacancy rate has fallen from 5.0 per cent in March 2017 to 0.6 per cent in February 2022. The asking rent for houses has increased 13.7 per cent over the past year.

Even with our international borders mainly closed over the past year, Sydney’s vacancy rate hit two per cent in February this year with the asking rent for houses soaring by 17.1 per cent over the past year, according to SQM Research.

It’s not enough for political parties to simply offer piecemeal funding for ‘affordable housing’ when there is currently a critical undersupply of rental properties that was written in the cards in 2017 when lending restrictions came into play.

Political parties must develop a significant and sustainable policy that increases the supply of rental properties around the nation in the vein of the National Rental Affordability Scheme, which was scrapped after only a few years.

With overseas migration set to soar over coming years, where are these new Aussies going to live if we don’t even have enough rental properties to house our current population?

A system needs to be developed to encourage the private and public sectors to work collaboratively together to increase rental supply and to improve rental affordability for tenants.