By Kate Hill, Adviseable

The Federal Budget has been and gone for another year, with cost-of-living pressures rightly a significant concern.

But this year’s budget was a little like a spendathon given that the Federal Election is due to be called any day now.

A temporary cut to the fuel excise will assist every one of us when we’re at the bowsers, given you don’t get much change (if any at all) from $100 to fill up your petrol tank at the moment.

There was also the announcement of a one-off $250 cash handout to Centrelink recipients, which is clearly a nice thing to have, but is not overly significant.

There were also multiple billions of dollars announced for myriad major infrastructure projects around the nation – including the regions – which are a good thing for the economies in each location.

When it comes to housing schemes, the government is clearly trying to address the difficulties that prospective property owners face saving a deposit.

The government announced the expansion of its various home guarantee schemes, which will assist first home buyers, as well as regional residents and single parents.

Under the expanded Home Guarantee Scheme, the government will more than double the places available to 50,000 per year.

It will make available:

- 35,000 guarantees each year under the First Home Guarantee, up from the current 10,000, from 1 July 2022

- 10,000 guarantees each year from 1 October 2022 to 30 June 2025 under a new Regional Home Guarantee

- 5,000 guarantees each year from 1 July 2022 to 30 June 2025 to expand the Family Home Guarantee.

Helping hand

Under the schemes, part of an eligible home buyer’s home loan will be guaranteed by the government, enabling Australians to enter the property market sooner and with a smaller deposit.

For first home buyers that deposit size could be as low as five per cent of the purchase price and for single parents it could be just two per cent.

One of the pleasing things about these schemes is that the eligibility criteria is perhaps more cognisant of market reality than they usually are.

Although, the first home buyer scheme only applies to the purchase or construction of a new property, which is frustrating.

However, the income caps of $125,000 for singles and $200,000 for couples are quite generous compared with previous initiatives.

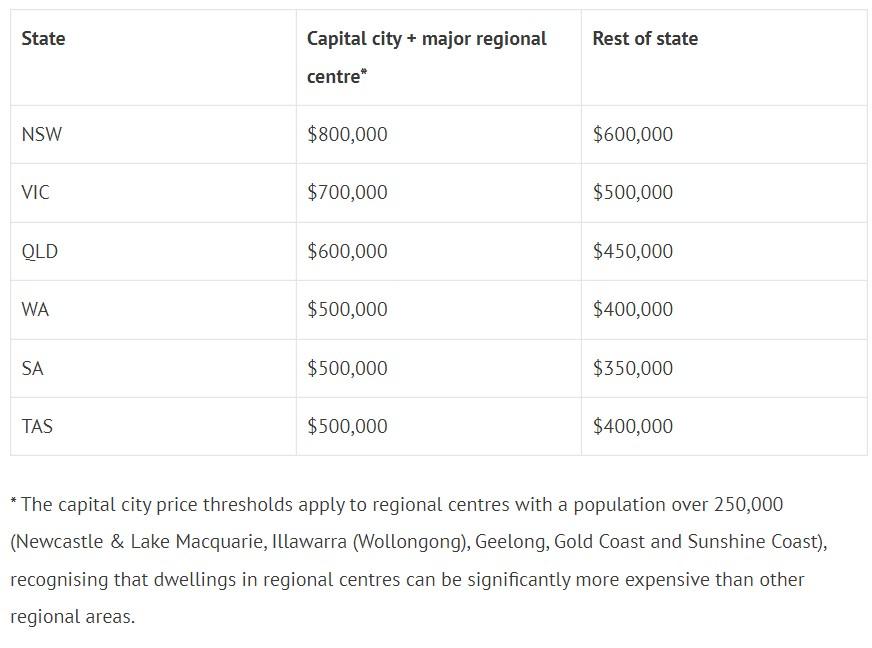

Likewise, the maximum price caps for the Family Home Guarantee, which is specifically for single parents, are also reasonably realistic for each location.

Final thoughts on the Family Home Guarantee

The Family Home Guarantee is the one that I believe will make the biggest difference to a person’s financial future – whether they are female or male.

With rental markets critically undersupplied around the nation, helping single parents make the usually difficult transition from being a tenant to a homeowner will make a significant difference to their lives as well as to the lives of their children.

Research has previously found that by 2056, the rate of homeownership for over-65s in Australia will have declined from about 76 per cent today to about 57 per cent.

These declining rates of homeownership may see more people spending their twilight years living in poverty, especially women and men who may never had the chance to purchase their own home due to being a single parent.